There has been a mixed reaction from packaging recycling experts to the third quarter packaging recycling data released this week.

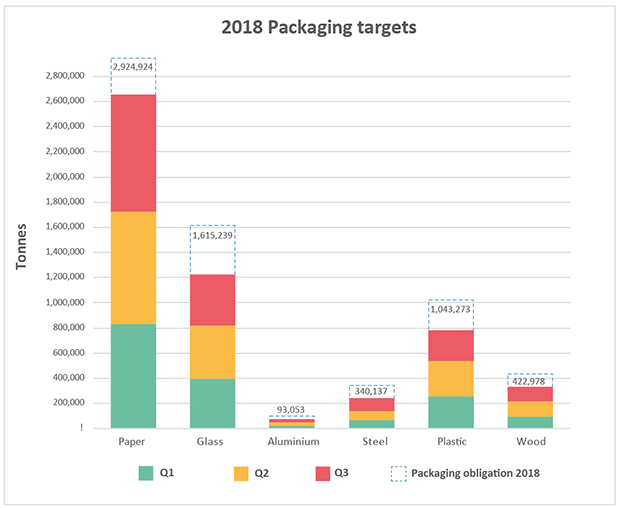

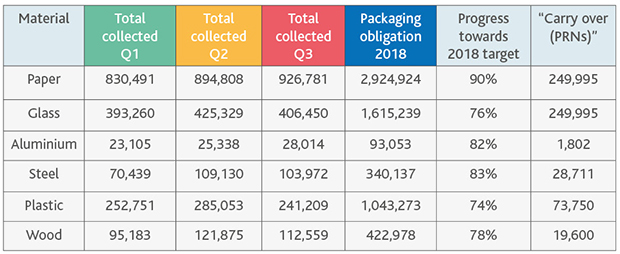

The Q3 packaging data, published on the National Packaging Waste Database (NPWD) website, shows the overall volume of material collected to meet targets during the three months from July to September.

Data suggests that despite some squeeze in export markets, paper has continued to trade strongly, with just over 925,000 tonnes of recycling in Q3, following similar performance in the first two quarters of the year. This, coupled with a further 200,000 available to carry over from last year, means that packaging producers are likely to their recycling targets for the material this year.

This means that any excess will be able to go towards general recycling for the other material.

Paper achieved 90% of its target in the first three quarters, while others still have some way to go

Aluminium was the only other material to see a rise from the previous quarter, with plastic seeing the highest drop in material collected compared to the preceding quarter. The figures also show that plastic would need around 270,000 tonnes of material to be registered in Q4 to meet targets without factoring in the carryover figures.

Adrian Hawkes, policy advisor at Valpak, said the figures revealed nothing unexpected, but show that further strain could be added onto the market next year.

“Nothing in the figures was particularly unexpected. It does seem to show that the UK is more-or-less on track to meet targets but some materials are a lot closer than previous years, and the scope for bringing things over is reduced,” he explained.

Mr Hawkes added: “This increases the challenges in 2019. It is difficult to see how prices could fall in such a tight market.”

Carry-over

Some observers have pointed to the amount of excess material carried over from 2017 as being important in achieving this year’s targets.

As this week’s release shows, a total of around 250,000 tonnes of paper was carried over from 2017, which if added to the total collected throughout 2018 to date, would represent 99% progress towards the yearly target for the first three quarters of the year.

Robbie Staniforth, policy manager at Ecosurety, explained that he felt the figures were better than many had anticipated.

“We are actually surprised at how good the figures look,” he explained.

Mr Staniforth added: “Considering all the doom and gloom regarding exporting material, we are around three-quarters of the way throughout the year and most targets stand at around 75%, and better once the carryover figures are added as well.

“It remains to be seen if the PRN prices will fall or not, but looking at the raw figures the situations looks OK. There are also a few more submissions to be made, and we think all in all it looks ok, even for plastics. The raw data looks encouraging.”

Prices

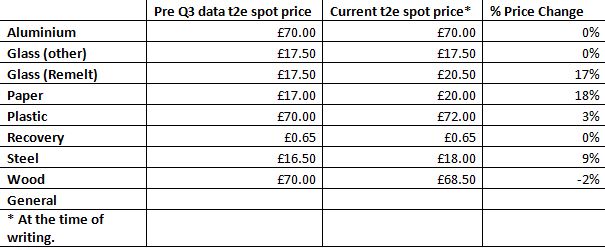

The third quarter statistics often give an indication of how likely targets are to be met, which can have a knock-on impact on the wider PRN market if significant volumes of material are needed to meet targets.

Ian Andrews, director of PRN Trader, added that despite the results “not being as strong as some would have liked”, they are not are unlikely to affect PRN prices greatly.

Plastic is the furthest away from its 2018 target, although its been said that some may wait until Q4 to submit data

“The figures aren’t’ quite as strong as perhaps some may have thought, but at the same time, they are not disastrous. Paper, for example, saw its strongest quarter, and once Q4 figures are brought in and perhaps some of the carry-over from last year it will comfortably meet its target,” he stated.

Mr Andrews continued: “Likewise, Aluminium also saw its highest quarter, so I don’t think we can expect to see prices ramp up as these trends are to be expected due to the current PRN market.

“Plastics also looks reasonably comfortable, and with the added Q4 figures it could meet targets. Some people have also only just registered, so new players coming into the market in an attempt to get cheaper prices could also help the overall figures.”

Rise

Meanwhile, Tom Rickerby, head of business development at the Environment Exchange, said that the market response to the figures has already seen some prices for PRNs rise.

According to the below table provided by the company, PRN prices rose for Glass (Remelt), paper and plastic and steel in response to the figures.

Some have claimed that prices have already begun to increase after the release of the figures Source: Environment Exchange

The post Q3 PRN figures prompt mixed response appeared first on letsrecycle.com.

Source: letsrecycle.com Plastic