The prices paid for waste plastic materials for recycling – such as mixed bottles and film – are coming under pressure after the plastics PRN last week ‘fell off a cliff’.

Prices paid for packaging waste recovery notes (PRNs) fell from around the £230 mark in May to as low as just £130 by Friday (12 June), significantly pushing down the prices paid for many grades of plastic bottles and film.

PRNs are recycling evidence and obligated businesses are required under producer responsibility legislation to purchase them to demonstrate they have paid towards the cost of material they place on the market. The prices paid for lower grade waste plastics have traditionally relied heavily on the PRN subsidy while top grade material has been shifted without PRN support because of its value.

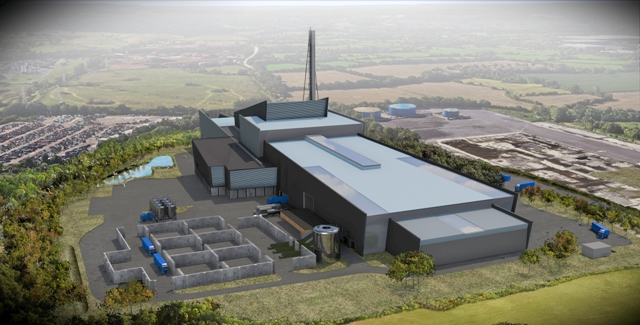

Viridor is one company developing UK plastics recycling infrastructure; it is completing a plastics plant alongside its energy from waste facility in Avonmouth

Recyclers told letsrecycle.com that lower grades such as 80:20 and 90:10 film have been particularly hard hit, alongside natural HDPE, pots, tubs and trays (PTT) and mixed bottles – with prices paid for the latter falling by as much as £70 a tonne.

The falls are a contrast to the recent plastics for recycling market as prices have held up surprisingly well despite the coronavirus pandemic, which has seen oil prices and in turn virgin plastics prices fall.

First quarter

Several factors may be behind the fall in the value of the plastics PRN.

Plastics had a good first quarter in terms of PRNs and monthly data also suggests more plastics is being recycled.

More reprocessors are registering to issue PRNs, largely because they have seen the value of the PRN rise in recent years – while it has reduced recently the value remains high compared to the numbers generally seen in the past. The number of businesses accredited to reprocess or export plastics for reprocessing has also soared this year to 255 from 191, with an additional 25 accredited for reprocessing in the UK.

Recent UK investments have include a film facility by Jayplas in the Midlands

And, there has been a move away from plastic packaging for some products as well as the reduction in the amount of plastic being used. Alternatives have include metal and paper.

PRN values have been impacted by a fall in plastics packaging demand due to uncertainty around the recessionary impact of the pandemic, with some British businesses, such as sandwich maker Adelie Foods, hit hard and going into administration and temporary closures at others.

The reduction in PRN value may also reflect the fact that some compliance schemes are hesitant to buy PRNs because they want to ensure that they have payment from a member company before purchasing the evidence.

“The PRN has collapsed in the last ten days” one recycler told letsrecycle.com. “Obligated companies are worried about their business and if they have a cash flow problem PRNs are not a priority. Compliance schemes don’t want to buy PRNs if they might not be needed.”

“The PRN price has fallen off a cliff which is having an impact on plastics prices”, said another recycler. “This is a price correction that was probably overdue.”

[gallery_placement]

Obligations

The pandemic is also causing uncertainty over the obligation levels for all materials for 2020. The total obligation would normally have been higher than in 2019 because targets are raised for most materials each year.

However, 2020 could be an anomaly because the number of company registrations may be down so that rather than exceeding last year’s 8.2 million tonnes and rising to about 8.3 million tonnes for 2020, the current year figure could be similar to last year. Recent data shows the obligation for the current year at around 7.8 million tonnes with about 6,423 registrations so far. Last year there were a total of 7,030 registrants

The pandemic is the unknown in terms of the eventual obligation. Some obligated businesses are still to supply data, with the Environment Agency extending the registration deadline until July for businesses that have faced disruption because of COVID-19 in terms of data submission. With staff furloughed and directors away from their teams, pulling the numbers together has become harder than usual.

The likely reduction in packaging activity this year, with the almost four month closure of the hospitality sector, will also mean that 2021 could see a big surplus of PRNs – because of a low obligation based on 2020 numbers. So, if there happened to be a shortfall in any material at the end of 2020, there may be an agreement by Defra to “carry back” evidence. Normally there is an allowed carry over of evidence from one year to the next.

There may be an agreement by Defra to “carry back” evidence

Bounce back

There are many views on how the market may develop – one commentator suggested some recyclers were stockpiling material to see if the PRN improved and suggested that demand for PRNs will “bounce back” as businesses start to re-open.

Others remarked that the plastic tax – which will see companies required to pay £200 per tonne for packaging with less than a 30% recycled content from 2022 – could not come soon enough. There are already fears that this could be delayed until mid-2023.

Pandemic

Any respite from lower prices for waste plastics is unlikely to be driven by a rising oil price in the short term at least. Oil markets remain at low levels with concern currently over the level of coronavirus in the United States and India and the potential return of the pandemic in China with cases in the Beijing area over the past few days.

In May, Plastics Recyclers Europe warned that plastics recycling in Europe could ‘cease to become profitable’ unless further government support was offered (see letsrecycle.com story).

The post Plastics prices hit by falling PRN value appeared first on letsrecycle.com.

Source: letsrecycle.com Plastic